Table of Contents

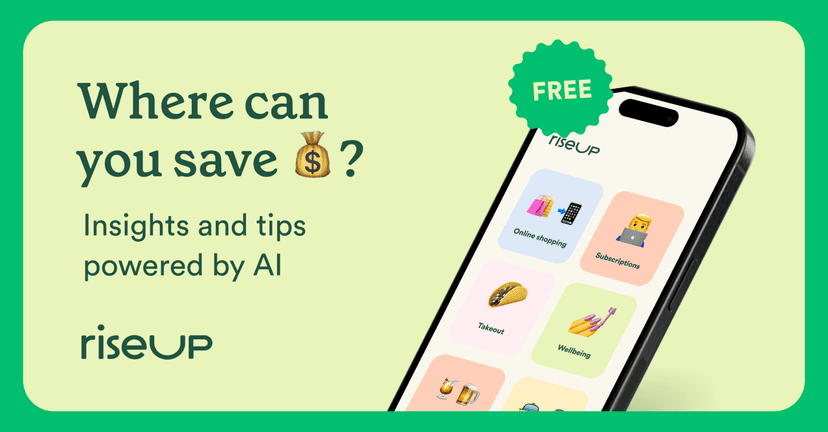

Managing your finances can feel overwhelming, but what if there was a tool to simplify the process? RiseUp Money Insights promises to take the stress out of budgeting and help you understand your spending habits better. This free AI-driven tool aims to give you tailored advice without the burden of fees. Let’s dive in and see how RiseUp can assist you in taking control of your money.

Riseup“>

Riseup“>

Riseup Review

RiseUp Money Insights is an innovative tool designed to provide users with comprehensive insights into their personal finances. It simplifies the often-daunting task of budgeting by presenting your spending habits in a clear and concise way. With AI technology at its foundation, RiseUp offers personalized tips and advice catered to your unique financial situation. This means that every user can benefit from custom insights tailored to their spending patterns, helping you save more effectively.

Key Features

- Snapshot of personal spending

- Tailored insights and tips specifically for the individual user

- User-friendly interface that promotes easier budgeting and saving

Pros and Cons

Pros

- Free to use, making it accessible for everyone

- Utilizes AI technology to provide personalized advice

- Simplifies the process of tracking and managing finances

Cons

- May not offer as comprehensive features as some paid financial management tools

- Dependent on user input for the most accurate insights

Pricing Plans

The tool is available for free, making it an attractive option for individuals looking to improve their financial management without incurring costs.

Wrap up

In conclusion, RiseUp Money Insights is a valuable tool for anyone wanting to take control of their finances without spending a dime. Its personalized insights and easy-to-use features make budgeting simpler and more effective. While it may lack some advanced options found in paid tools, its no-cost model could be precisely what many users need to enhance their financial health.