Table of Contents

The audiobook industry is exploding, and if you're curious about just how big this market has become, you're in for a treat. From commuters to gym-goers, millions of people are discovering the joy of listening to books, and the numbers tell an incredible story of growth and opportunity.

Whether you're an author considering audiobook production, an investor eyeing the market, or simply fascinated by publishing trends, these statistics will give you a comprehensive view of where the audiobook industry stands today and where it's headed. Let's dive into the fascinating world of audio entertainment!

Global Audiobook Market Size

The audiobook market has transformed from a niche product to a massive global industry, and the numbers are truly staggering.

- $10.88 Billion in 2025: The global audiobook market is projected to reach approximately $10.88 billion in 2025. This represents an incredible milestone in the industry's evolution, showing how mainstream audio content has become.

- $9.84 Billion Worldwide Revenue: Conservative forecasts place worldwide audiobook revenue at around $9.84 billion for 2025, confirming the sector's ongoing expansion and the increasing adoption of audiobooks across all demographics.

- Fastest Growing Book Format: Audiobooks are now the fastest-growing segment in the publishing industry, outpacing both ebooks and print books in terms of percentage growth year over year.

- Digital Transformation Leader: The shift from physical audiobooks (CDs) to digital streaming and downloads is complete, with over 95% of audiobook consumption now happening through digital platforms.

Global Audiobook Market Overview

| Metric | Value (2025) | Growth Rate |

|---|---|---|

| Market Size | $10.88 billion | 26.4% CAGR |

| Worldwide Revenue | $9.84 billion | — |

| Digital Share | 95%+ | Dominant |

| Physical Share | <5% | Declining |

The audiobook market's explosive growth mirrors trends we've seen in other digital content sectors, much like the evolution of self-publishing and ebook sales on platforms like Amazon. Technology is democratizing access to books in all formats.

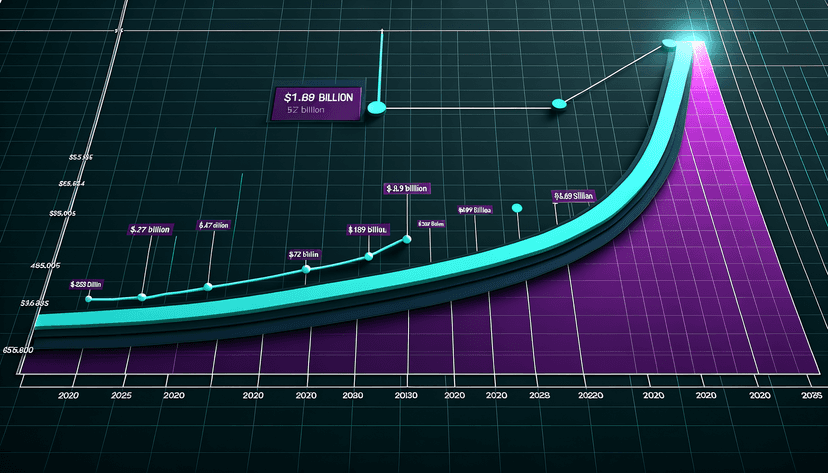

Explosive Market Growth Projections

If you think the current market size is impressive, wait until you see where it's headed. The audiobook industry is on a rocket ship trajectory.

- $56.09 Billion by 2032: Industry analysts project the global audiobook market will reach an astounding $56.09 billion by 2032. That's more than 5x growth in just seven years!

- 26.4% Annual Growth Rate: The market is expected to grow at a compound annual growth rate (CAGR) of 26.4% from 2025 to 2032. This is one of the highest growth rates in any entertainment sector.

- Doubling Every 3 Years: At the current growth rate, the audiobook market is essentially doubling in size every three years, creating massive opportunities for authors, publishers, and platform providers.

- Outpacing Traditional Publishing: While traditional book publishing grows at single-digit rates, audiobooks are growing 5-10x faster, fundamentally reshaping the publishing landscape.

Audiobook Market Growth Trajectory (2025-2032)

| Year | Market Size (USD) | Year-over-Year Growth |

|---|---|---|

| 2025 | $10.88 billion | — |

| 2027 | $17.38 billion | +26.4% |

| 2029 | $27.75 billion | +26.4% |

| 2032 | $56.09 billion | +26.4% |

This growth rate is remarkable and reflects changing consumer behavior worldwide. People are increasingly multitasking—listening to books while commuting, exercising, cooking, or doing household chores. Audiobooks fit perfectly into our busy, mobile-first lifestyles.

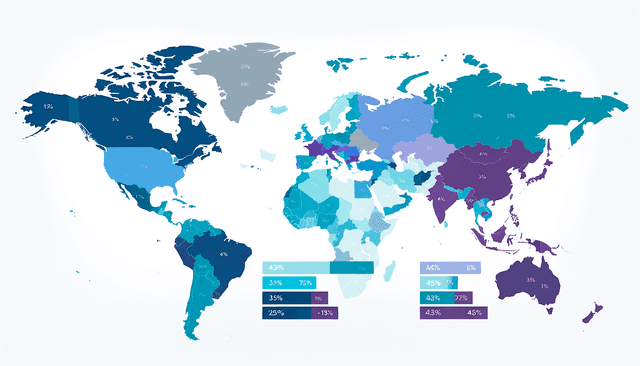

Regional Market Breakdown

The audiobook boom is global, but some regions are growing faster than others. Let's explore the regional dynamics shaping this industry.

- Asia-Pacific: The Growth Leader: The Asia-Pacific region is experiencing the fastest growth rate globally, driven by massive smartphone penetration, rising middle-class populations, and increasing English proficiency in countries like India, China, and Southeast Asia.

- Europe: $2.08 Billion Market: The European audiobook market was valued at approximately $850 million in 2020 and is projected to reach $2.08 billion by 2025, growing at a CAGR of about 18.61%. This represents more than doubling in just five years!

- North America: Still the Largest: While Asia-Pacific shows the fastest growth rate, North America (particularly the United States) remains the largest single market, accounting for approximately 40-45% of global audiobook revenue.

- Emerging Markets Accelerating: Latin America, Africa, and the Middle East are showing strong adoption patterns, particularly among younger, tech-savvy demographics with high mobile device usage.

Regional Market Comparison

| Region | Market Size (2025) | CAGR | Key Driver |

|---|---|---|---|

| North America | ~$4.5 billion | 22% | Mature market, high penetration |

| Europe | $2.08 billion | 18.61% | Growing smartphone usage |

| Asia-Pacific | ~$2.8 billion | 35%+ | Smartphone boom, rising literacy |

| Rest of World | ~$1.5 billion | 25% | Emerging middle class |

European Market Growth Detail

| Year | European Market Size |

|---|---|

| 2020 | $850 million |

| 2025 | $2.08 billion |

| Growth | +144.7% |

| CAGR | 18.61% |

The regional diversity creates opportunities for publishers and platforms to localize content, adapt pricing strategies, and tap into underserved markets with high growth potential.

Major Players Dominating the Industry

Several major tech and publishing companies are competing for dominance in the audiobook space, each bringing unique strengths and innovations.

- Amazon's Audible: The Market Leader: Audible remains the undisputed king of audiobooks, controlling an estimated 60-70% of the global market. With over 500,000 titles and millions of subscribers worldwide, Audible's dominance mirrors Amazon's position in ebook sales.

- Apple Books: Premium Alternative: Apple's audiobook platform integrates seamlessly with iOS devices and offers competitive pricing without subscription requirements. While smaller than Audible, Apple is gaining ground with its vast user base and superior audio quality.

- Google Play Books & Audiobooks: Google's entry into audiobooks leverages its massive Android ecosystem, providing access to millions of users worldwide. While still building its catalog, Google's reach is formidable.

- Rakuten Kobo: International Focus: Kobo has carved out a strong position in international markets, particularly in Canada, Europe, and Asia-Pacific, offering competitive pricing and a growing audiobook selection.

- Spotify: The Disruptor: Spotify's massive investment in audiobooks (and podcasts) is reshaping the competitive landscape. With 500+ million users globally, Spotify's bundled approach could be game-changing.

Major Audiobook Platform Comparison

| Platform | Market Share | Catalog Size | Key Advantage |

|---|---|---|---|

| Audible (Amazon) | 60-70% | 500,000+ titles | Largest selection, exclusive content |

| Apple Books | 10-15% | 200,000+ titles | iOS integration, no subscription |

| Google Play | 5-8% | 150,000+ titles | Android ecosystem |

| Kobo | 3-5% | 100,000+ titles | International presence |

| Spotify | 5-10% | 300,000+ titles | Bundled with music |

| Others | 5-10% | Varies | Niche markets |

Similar to how Amazon dominates ebook sales, Audible's position in audiobooks seems secure for now. However, the competition is intensifying as tech giants recognize the market's potential.

Subscription Models Driving Growth

One of the key drivers of audiobook market growth is the rise of subscription-based models that offer incredible value to listeners.

- Audible's Subscription Dominance: Audible's subscription model (typically $14.95/month for 1 credit) has become the industry standard. Subscribers get access to exclusive content, discounted additional purchases, and member-only sales.

- Unlimited Listening Services: Platforms like Scribd and Audiobooks.com offer unlimited listening for a flat monthly fee, appealing to heavy consumers who might listen to 5-10 books per month.

- Bundled Services Growing: Spotify's integration of audiobooks with music subscriptions, and Amazon's Kindle Unlimited expansion into audio, are creating new consumption patterns where audiobooks are part of larger entertainment bundles.

- Library Services Expanding: Public libraries through apps like Libby and Hoopla are providing free audiobook access to millions, introducing new listeners to the format without financial barriers.

- Premium Features Attract Subscribers: Exclusive content, author interviews, behind-the-scenes features, early access to new releases, and curated recommendations are all subscription perks that drive sign-ups and retention.

Subscription Model Comparison

| Service Type | Typical Price | Model | Best For |

|---|---|---|---|

| Credit-Based (Audible) | $14.95/mo | 1 book per month + sales | Selective listeners |

| Unlimited (Scribd) | $11.99/mo | Unlimited listening | Heavy consumers |

| Bundled (Spotify) | $10.99/mo | Music + audiobooks | Multi-format users |

| À la carte (Apple) | Per book | Individual purchases | Occasional listeners |

| Library (Free) | $0 | Borrow & return | Budget-conscious |

The subscription model's success in audiobooks parallels Netflix's impact on video streaming—it's transformed consumption patterns and dramatically expanded the market by making audiobooks more accessible and affordable.

Consumer Behavior and Listening Habits

Understanding how, when, and why people listen to audiobooks reveals fascinating insights about this growing market.

- Commuting is King: The #1 listening location is during commutes, with over 65% of audiobook listeners reporting they listen while driving or using public transportation. This makes "dead time" productive and enjoyable.

- Multitasking Listeners: Audiobook listeners are expert multitaskers—they listen while exercising (45%), doing household chores (58%), cooking (42%), and even working (25% report listening during certain work tasks).

- Average Listener Stats: The average audiobook listener completes 15-18 books per year, compared to 12 books for traditional readers. Audio format actually increases total book consumption!

- Speed Listening Trend: Over 70% of audiobook listeners use speed controls, with 1.25x to 1.5x being the most popular settings. This allows listeners to consume more content in less time.

- Genre Preferences: Mystery/thriller leads audiobook genres, followed by self-help, romance, science fiction, and biography. Fiction dominates with about 60% of audiobook sales.

Where and When People Listen to Audiobooks

| Activity | Percentage of Listeners |

|---|---|

| Commuting/Driving | 65% |

| Household chores | 58% |

| Exercising/Walking | 45% |

| Cooking | 42% |

| Before bed | 38% |

| Working | 25% |

| Traveling | 55% |

Audiobook Listener Demographics

| Demographic | Key Insights |

|---|---|

| Age 18-34 | Fastest growing segment, 40% of listeners |

| Age 35-54 | Heaviest consumers, 38% of listeners |

| Age 55+ | Growing adoption, 22% of listeners |

| Gender Split | 55% female, 45% male |

| Education Level | 68% have college degrees or higher |

| Income Level | Skews higher income ($50K+) |

These consumption patterns show that audiobooks aren't replacing traditional reading—they're expanding it by fitting books into times and places where traditional reading isn't possible.

Technology Driving Audiobook Adoption

Technological advancements are the rocket fuel behind audiobook industry growth, making production easier and consumption more accessible.

- Smartphone Penetration: Global smartphone adoption (now over 6.8 billion users) is the single biggest driver of audiobook growth. With a powerful playback device in everyone's pocket, the barrier to entry is essentially zero.

- AI Narration Revolution: Artificial intelligence is transforming audiobook production. AI-narrated books are becoming increasingly natural-sounding and can be produced at a fraction of the cost of human narration, opening doors for more authors.

- Improved Audio Quality: Better compression algorithms mean higher quality audio with smaller file sizes, making downloading and streaming faster and more efficient even on slower connections.

- Smart Speaker Integration: Devices like Amazon Echo, Google Home, and Apple HomePod make audiobook listening as simple as voice commands, integrating seamlessly into smart homes.

- Car Integration: Apple CarPlay and Android Auto bring audiobooks directly into vehicle entertainment systems, making the commute experience seamless.

- Offline Listening: Download capabilities mean listeners aren't dependent on internet connectivity, crucial for commuters and travelers.

Technology Impact on Audiobook Industry

| Technology | Impact | Market Effect |

|---|---|---|

| Smartphone Proliferation | Universal playback devices | Massive audience expansion |

| AI Narration | Lower production costs | More titles available |

| Streaming Technology | Instant access | Impulse purchases increase |

| Smart Speakers | Hands-free listening | Home consumption grows |

| Car Integration | Seamless commute listening | Daily habit formation |

| 5G Networks | Faster downloads/streaming | Better user experience |

The technology stack powering audiobooks today is light-years ahead of the CD era. This technological evolution, combined with changing consumer preferences, creates the perfect storm for exponential growth.

Author and Publisher Opportunities

The audiobook boom isn't just good for platforms and listeners—it's creating significant opportunities for authors and publishers.

- Additional Revenue Stream: For authors with existing books, audiobooks represent pure incremental revenue. Many authors report that audiobooks add 20-40% to their total book income.

- Reaching New Audiences: Some readers exclusively consume audiobooks. By not having an audio version, authors miss this entire audience segment—potentially 25-30% of total market.

- Higher Price Points: Audiobooks typically sell for $15-30, significantly higher than ebook prices ($2.99-9.99), resulting in higher per-unit revenue even after narrator and production costs.

- Royalty Rates Vary: Through ACX (Audible's audiobook creation exchange), authors can earn 25-40% royalties depending on exclusivity. Non-exclusive distribution offers lower royalties but wider reach.

- Self-Published Author Access: Just like self-publishing transformed the book industry, platforms like ACX democratize audiobook production, allowing any author to create and sell audiobooks.

- AI Narration Lowers Barriers: New AI narration services cost $100-500 per title compared to $2,000-10,000 for professional human narration, making audiobooks accessible to more authors.

Audiobook Production Options for Authors

| Production Method | Cost | Quality | Best For |

|---|---|---|---|

| Professional Studio | $5,000-15,000 | Highest | Major releases |

| Professional Narrator (Home) | $2,000-5,000 | High | Most commercial books |

| Author Self-Narration | $500-2,000 | Variable | Nonfiction, memoir |

| AI Narration (Premium) | $300-800 | Good | Backlist, testing market |

| AI Narration (Basic) | $100-300 | Acceptable | Budget-conscious authors |

Audiobook Royalty Comparison

| Distribution | Royalty Rate | Reach | Requirements |

|---|---|---|---|

| ACX Exclusive | 40% | Audible, Amazon, iTunes | 7-year exclusivity |

| ACX Non-Exclusive | 25% | Audible, Amazon, iTunes | None |

| Findaway Voices | 80% | 20+ retailers | Pay production costs |

| Author Direct | 90-95% | Author's website | Self-distribution |

| Traditional Publisher | 15-25% | All major platforms | Publishing contract |

For many authors, especially those in the self-publishing space, audiobooks represent one of the most exciting opportunities to increase income and reach new readers in 2025 and beyond.

Future Trends and Predictions

What does the future hold for audiobooks? Several emerging trends are poised to reshape the industry over the next few years.

- AI Narration Becomes Standard: By 2030, AI narration is expected to account for 40-50% of new audiobook productions. The quality gap between AI and human narration continues to shrink, making AI the economical choice for many titles.

- Interactive Audiobooks: Choose-your-own-adventure style audiobooks, educational content with embedded quizzes, and enhanced audiobooks with sound effects and music will become more common.

- Personalized Recommendations: AI-powered recommendation engines will get better at predicting listener preferences, increasing discovery of new authors and titles.

- Global Language Expansion: Automated translation and narration will make audiobooks available in dozens of languages simultaneously, opening massive international markets.

- Integration with Smart Glasses/AR: As augmented reality glasses become mainstream, audiobooks will integrate with visual overlays, creating hybrid reading/listening experiences.

- Podcast-Audiobook Convergence: The lines between serialized fiction podcasts and audiobooks will blur, with hybrid formats gaining popularity.

- Direct-to-Fan Models: More authors will bypass traditional platforms to sell audiobooks directly to fans via Patreon, Substack, and personal websites, retaining higher margins.

Audiobook Industry Predictions (2025-2032)

| Trend | Current State (2025) | 2032 Projection |

|---|---|---|

| Market Size | $10.88 billion | $56.09 billion |

| AI Narration Share | 15% | 45% |

| Available Languages | ~30 major languages | 100+ languages |

| Interactive Titles | <1% | 15% |

| Direct Author Sales | 5% | 20% |

| Smart Device Integration | 25% | 75% |

The audiobook industry is still in its growth phase, much like streaming video was a decade ago. The next seven years will bring innovations we can barely imagine today, creating opportunities for early movers and adaptable players.

Key Takeaways

Let's recap the most important audiobook statistics and insights:

- Explosive Growth: The audiobook market is growing at 26.4% annually, from $10.88 billion in 2025 to a projected $56.09 billion by 2032—more than 5x growth in seven years.

- Global Phenomenon: While North America leads in absolute size, Asia-Pacific shows the fastest growth (35%+ CAGR), driven by smartphone penetration and rising literacy rates.

- Platform Dominance: Audible controls 60-70% of the market, but competition from Apple, Google, Spotify, and others is intensifying, benefiting both creators and consumers.

- Subscription Success: Subscription models have democratized access, with services ranging from credit-based (Audible) to unlimited (Scribd) to bundled (Spotify) offerings.

- Multitasking Format: Audiobooks excel during commuting (65%), exercise (45%), and household tasks (58%), turning "dead time" into productive reading time.

- Technology Enabler: Smartphone proliferation, AI narration, streaming technology, and smart device integration are eliminating barriers and expanding the market.

- Author Opportunity: Audiobooks add 20-40% to author revenues, with new AI narration tools making production accessible to all authors at costs as low as $100-500 per title.

- Future is Bright: AI narration, interactive formats, global language expansion, and direct-to-fan sales will continue transforming the industry through 2032 and beyond.

Conclusion

The audiobook industry in 2025 is experiencing a golden age of growth, innovation, and opportunity. With a market size approaching $11 billion and projected to reach over $56 billion by 2032, audiobooks have transformed from a niche product to a mainstream entertainment format.

This growth is driven by perfect storm of factors: ubiquitous smartphones, improved technology, changing consumer habits, competitive platforms, and accessible production tools. The result is an industry that's expanding faster than almost any other entertainment sector.

For authors, publishers, and platforms, the message is clear: audiobooks are no longer optional—they're essential. Whether you're a traditionally published author, an indie self-publisher, or a platform provider, the audiobook market offers tremendous opportunities for those willing to adapt and innovate.

For listeners, the golden age means more choices, better prices, higher quality, and innovative formats that fit seamlessly into busy lives. The future of audiobooks isn't just about listening to books—it's about experiencing stories in entirely new ways.

Ready to dive into the audiobook revolution? Whether you're creating them or consuming them, there's never been a better time to be part of this exciting industry. The future is audio, and it sounds amazing! 🎧